Are Smart Home Insurance Policies Worth the Investment?

Are Smart Home Insurance Policies Worth the Investment?

In an increasingly connected world, “Are Smart Home Insurance Policies Worth the Investment?” is a timely question for homeowners embracing smart technology. This comprehensive guide explores what smart home insurance policies offer, their pros and cons, and whether they justify the cost.

Table of Contents

- Introduction: What Is a Smart Home Insurance Policy?

- Understanding Smart Home Insurance Benefits

- Evaluating Costs and Premium Comparisons

- Coverage Details: What’s Actually Included?

- Comparing Smart Home Insurance vs. Standard Coverage

- Use Cases: Ideal Scenarios for Smart Home Insurance

- Potential Drawbacks and Limitations

- Tips for Shopping Smart Home Insurance

- Does Data Privacy Matter?

- Real-Life Customer Experiences

- Verdict: Are Smart Home Insurance Policies Worth the Investment?

- Future Outlook: Insurance & Smart Homes

1. Introduction: What Is a Smart Home Insurance Policy? {#introduction}

When people ask, “Are Smart Home Insurance Policies Worth the Investment?”, they often wonder what sets them apart. A smart home insurance policy is a homeowner’s insurance plan that offers premium discounts, monitoring services, or enhanced coverage in exchange for installing smart devices—like leak detectors, smart thermostats, or security sensors.

Smart home insurance policies integrate IoT (Internet of Things) into risk management. By detecting issues early and preventing accidents, these policies reduce claims and potentially save homeowners money. The core question remains: Are Smart Home Insurance Policies Worth the Investment? Let’s explore.

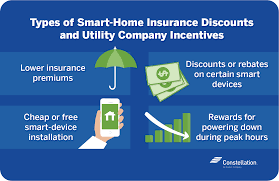

2. Understanding Smart Home Insurance Benefits {#benefits}

2.1 Lower Premiums Through Prevention

One of the standout advantages of Are Smart Home Insurance Policies Worth the Investment? is the opportunity for lower premiums. Insurers reward homes equipped with smart leak detectors, smoke alarms, and security systems with discounts—sometimes 5% to 20% annually. Over time, savings may offset the initial device costs.

2.2 Real-Time Alerts and Damage Prevention

Smart devices alert homeowners to issues immediately—water leaks, freezing pipes, high humidity, smoke, or intruders. For example, smart water detectors can shut off valves or warn users before flooding begins. These early interventions reduce claim frequency and mitigate damage.

2.3 Enhanced Safety and Peace of Mind

Beyond financial benefits, there’s peace of mind. Knowing your home is monitored—even when you’re away—makes homeowners feel more secure. This added reassurance contributes significantly when asking: Are Smart Home Insurance Policies Worth the Investment?

2.4 Additional Value-Added Services

Some insurers offer bundled services—like emergency repair dispatch, monitoring centers, or mobile dashboards—to enhance value. These extras may tip the balance on whether Are Smart Home Insurance Policies Worth the Investment?

3. Evaluating Costs and Premium Comparisons {#costs}

3.1 Upfront Smart Device Costs

Implementing a smart home system requires buying and installing compatible devices—ranging from $30 for a flood sensor to over $200 for a smart security camera or thermostat.

When weighing Are Smart Home Insurance Policies Worth the Investment?, factor in device costs versus annual insurance savings.

3.2 Premium Discount Scenarios

Not every insurer offers the same deal. Some might offer a 5% discount for two smart devices; others might provide a tiered system—10 devices bring bigger savings. Let’s examine an example:

- Homeowner invests $200 in sensors → premium drops from $1,200 to $1,080 (10% discount).

- Annual savings of $120.

- Break-even in under 2 years with added safety benefits.

Here, clearly, Are Smart Home Insurance Policies Worth the Investment? appears to be “yes.”

3.3 Long-Term ROI and Insurance Stability

Savings compound over years—especially if insurers lock in discounts. Just be mindful of policies requiring continuous operation or reporting. Thus, when asking Are Smart Home Insurance Policies Worth the Investment?, consider sustainability and insurance commitment levels.

4. Coverage Details: What’s Actually Included? {#coverage}

4.1 Standard vs. Supplemental Coverage

Smart home insurance may enhance coverage in the following ways:

- Water damage protection via leak sensors

- Fire prevention with connected smoke detectors

- Break-in deterrence through smart cameras and alarms

These can supplement—or in rare cases, replace—standard policy components, improving reliability and response time.

4.2 Claims Handling and Data Use

Some insurers leverage smart data during claims—verifying when a leak began or how long the alarm sounded. While this can speed up claims, policyholders must agree to data sharing. It’s a key factor when questioning Are Smart Home Insurance Policies Worth the Investment?

4.3 Exclusions and Device Failures

Be aware: device malfunctions may void discounts or coverages. Always read fine print. Insurers generally don’t cover damage if device wasn’t functional at the time of the incident.

5. Comparing Smart Home Insurance vs. Standard Coverage {#compare}

5.1 Side-by-Side Feature Table

| Feature | Standard Home Insurance | Smart Home Insurance Integrations |

|---|---|---|

| Basic property damage protection | ✅ | ✅ |

| Premium discounts with devices | ❌ | ✅ |

| Real-time alerts & response | ❌ | ✅ |

| Data-supported claims | ❌ | ✅ |

| Need to maintain device operation | ❌ | ⚠️ |

This comparison helps frame the question: Are Smart Home Insurance Policies Worth the Investment? as a trade-off between traditional coverage simplicity and tech-enhanced flexibility.

6. Use Cases: Ideal Scenarios for Smart Home Insurance {#use-cases}

6.1 Flood-Prone Areas

Homes in basements or flood zones benefit from smart leak detectors. Alerts can prevent costly water damage, making Are Smart Home Insurance Policies Worth the Investment? a no-brainer for these homeowners.

6.2 Vacation or Rental Properties

Unoccupied properties are high-risk. Smart systems offer control and mitigation—making insurance smarter and safer for host properties.

6.3 Families with Archival or High-Value Goods

Homes storing antiques, electronics, or artwork can use smart sensors to guard against temperature, humidity, or theft, strengthening the case that Are Smart Home Insurance Policies Worth the Investment?

7. Potential Drawbacks and Limitations {#limitations}

7.1 Reliance on Technology

Technology fails. Dead batteries or weak Wi-Fi can negate savings. If devices aren’t maintained, discounts can vanish—posing the question, Are Smart Home Insurance Policies Worth the Investment? with a caveat.

7.2 Privacy Concerns

Smart systems collect data. Not all users may feel comfortable with insurers accessing usage logs, sensor data, or incident history. If personal privacy matters, it might impact whether Are Smart Home Insurance Policies Worth the Investment?

7.3 Additional Policy Requirements

Some insurers require professional installation, certification, or monthly device deactivation audits—adding complexity. This can affect the calculus behind Are Smart Home Insurance Policies Worth the Investment?

7.4 Limited Coverage Expansion

While premiums drop, coverage limits often remain unchanged. The relative increase in protection might not always justify investment.

8. Tips for Shopping Smart Home Insurance {#tips}

8.1 Ask About Device Discounts and Participation Thresholds

Some insurers require three or more devices for discounts, others offer scaling. Always clarify with your provider.

8.2 Ensure Device Compatibility

Major providers often have preferred lists of compatible devices. Choose sensors officially recognized to ensure your premiums stay reduced.

8.3 Bundle with Other Smart Incentives

Some insurers extend smart-home discounts into broader umbrella policies or auto insurance when vehicles are also connected—enhancing value.

8.4 Review Data Policies Carefully

Read privacy policies. Clarify how data is stored, processed, shared, and what happens when switching insurers.

8.5 Compare Quotes

Don’t assume existing insurers offer the best smart-home deals. Shop around and compare quotes side-by-side.

9. Does Data Privacy Matter? {#privacy}

Smart systems log data that may be vulnerable. Here are key privacy questions:

- What data is collected? (timestamps, sensor readings, audio/video, thermostats?)

- Where is it stored? (cloud, local, encrypted?)

- Who has access? (insurer, subsidiaries, third parties?)

- Retention policy? (how long is data kept?)

A transparent, strong privacy policy indicates a trustworthy insurer. Privacy concerns can heavily influence whether Are Smart Home Insurance Policies Worth the Investment?

10. Real-Life Customer Experiences {#experiences}

Homeowners have shared experiences:

“My leak detector alerted me to a hidden pipe burst before major flooding—even on vacation. The insurer still honored the smart-home discount.”

“When my smoke detector didn’t report properly during a kitchen fire, they rescinded my discount—device uptime is critical.”

These stories highlight both benefits and responsibilities when evaluating Are Smart Home Insurance Policies Worth the Investment?

11. Verdict: Are Smart Home Insurance Policies Worth the Investment? {#verdict}

So, Are Smart Home Insurance Policies Worth the Investment? The answer mostly depends on:

- Risk level (e.g., flood zones, frequent travel)

- Budget and device deployment

- Willingness to manage devices long-term

- Comfort with data sharing

If you have moderate risk and are open to the tech, smart-home insurance can deliver real value—both in cost savings and improved protection. For low-risk homes or homeowners wary of tech and privacy trade-offs, premium gains may not justify the effort.

12. Future Outlook: Insurance & Smart Homes {#future}

Looking ahead, expect:

- More real-time risk-based pricing (your thermostat and security system directly affecting premiums

- Dynamic protection: no claims for months? your rate might auto-adjust

- Wearables & utilities integration: insurers encouraging lifestyle data usage for further discounts

In this evolving ecosystem, exploring Are Smart Home Insurance Policies Worth the Investment? is gaining ever more relevance.

Final Thoughts

Resolving Are Smart Home Insurance Policies Worth the Investment? depends on your property, priorities, and appetite for technology. This guide has equipped you to compare savings, assess coverage, consider privacy, and shop smart. For many, the investment is worth it—provided devices are well-managed and expectations are clear.